CIF Number Indian Bank: Unfamiliar with your Indian Bank CIF number? Discover the numerous benefits and conveniences you might be missing out on by not knowing this essential identifier.

In this post, I will provide comprehensive information about the Indian Bank CIF number, its significance, and various methods to locate it.

Understanding the Indian Bank CIF Number

CIF, an acronym for Customer Information File, is an 11-digit unique identifier assigned by the bank to every customer upon opening an account. This distinctive number serves to uniquely identify each customer within the bank’s records.

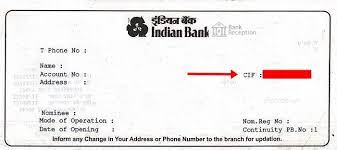

The Indian Bank CIF number can be found on the initial page of your passbook, accompanied by your name, account number, and branch code.

It is also accessible on your cheque book and account statement. Additionally, whether online or offline, there are various methods to retrieve it, which I will elucidate later in this article.

The Indian Bank CIF number holds significant importance for a range of banking services, including account transfers between branches, loan applications, and requesting a new cheque book. Its essential role extends to facilitating online banking, mobile banking, and other digital services provided by the bank.

The Importance of the CIF Number Indian Bank

Curious about the purpose of the Indian Bank CIF number and why it’s essential? There are several compelling reasons behind the necessity of the Indian Bank CIF Number, and here are a few of them:

To establish the connection between your Aadhaar card and your bank account, the Indian government has mandated that all bank account holders link their Aadhaar card for the purpose of preventing fraud and money laundering activities. To complete this process for your Indian Bank account, it is imperative to have your Indian Bank CIF number.

To ensure the accuracy of your KYC (Know Your Customer) details with Indian Bank, the updating process requires your Indian Bank CIF number.

To enroll in the convenient services of net banking and mobile banking, allowing you access to your bank account anytime and anywhere for tasks such as checking balances, transferring funds, paying bills, recharging your mobile, booking tickets, and more, registration with Indian Bank necessitates the use of your Indian Bank CIF number.

To facilitate the seamless transfer of your account when changing branches due to relocation or other reasons, without the need to close and open a new account, Indian Bank requires your Indian Bank CIF number to initiate the transfer process. This ensures a time-saving and hassle-free experience when moving your account from one branch to another.

To pursue various financial products such as loans, credit cards, or other offerings from Indian Bank, the application process involves filling out a form and submitting necessary documents. Among these documents, your passbook or cheque book, displaying your Indian Bank CIF number, is required for the application submission.

To address queries, complaints, or provide feedback concerning any service or product from Indian Bank, accessing their customer care and grievance redressal services is crucial. Whether through a toll-free call, email correspondence, live chat, or in-person branch visit, having your Indian Bank CIF number is necessary to avail the assistance and support provided by the customer care and grievance redressal department.

Clearly, the Indian Bank CIF number serves as a vital tool, proving to be immensely useful and necessary for a variety of purposes. Comparable to a key that unlocks numerous benefits and conveniences, it is imperative for account holders to be aware of their Indian Bank CIF number and ensure its safekeeping and confidentiality.

Locating Your Indian Bank CIF Number Online

One of the most straightforward methods to discover your Indian Bank CIF number is through the online banking facility offered by the bank. Here are the steps to locate your Indian Bank CIF number online:

Certainly! Here it is in bullet points:

- Visit the official website of Indian Bank’s “Know your CIF” page: https://apps.indianbank.in/emailstatement/ToFetchCIFNo.aspx

- Enter your Account Number, Registered Mobile Number, and verify the captcha.

- Click on the “Send OTP” button.

- Enter the OTP you just received on your registered mobile number and click on “Verify OTP.”

- You will see your Indian Bank CIF number displayed on the screen along with other details.

Locating Your Indian Bank CIF Number Without Your Passbook

If you find yourself without your passbook or have misplaced it, there are alternative methods to retrieve your Indian Bank CIF number. One such method involves using your cheque book. Here are the steps to locate your Indian Bank CIF number without a passbook:

- Retrieve a cheque leaf from your cheque book.

- Examine the bottom left corner of the cheque leaf.

- Identify a series of numbers separated by slashes (/).

- The first 10-digit number corresponds to your Indian Bank account number.

- The second 10-digit number represents your Indian Bank CIF number.

Locating CIF Number in the Indian Bank Mobile App

An alternative and user-friendly method to locate your Indian Bank CIF number involves utilizing the bank’s mobile application.

Download the IndOASIS Indian Bank Mobile App from either the Google Play Store or the Apple App Store, and complete the registration process by providing your debit card or internet banking credentials.

Below are the instructions for locating your CIF number within the Indian Bank mobile app:

- Open the Indian Bank mobile app on your smartphone.

- Log in using your user ID and MPIN or biometric authentication.

- Tap on the “Accounts” option in the center of the screen.

- Select the specific account number for which you wish to find the CIF Number.

- Your Indian Bank CIF number will be displayed on the screen, along with other details like Account Number and IFSC.

How to Retrieve Your CIF Number in Indian Bank via SMS?

If internet or mobile app access is unavailable, you can still obtain your Indian Bank CIF number by sending an SMS from your registered mobile number. Follow these steps to retrieve your CIF number in Indian Bank via SMS:

- Type “CIF” and send it to 94443-94443.

- You will receive an SMS from the bank containing your Indian Bank CIF number and additional details.

Obtaining Indian Bank CIF Number through Customer Care

The final approach to retrieve your Indian Bank CIF number is by contacting the bank’s customer care helpline.

You can dial the toll-free numbers 1800 4250 0000 or 1800 425 4422 from any landline or mobile phone.

Follow these steps to obtain your CIF number from Indian Bank by calling customer care:

- Call the customer care number and select your preferred language.

- Opt for the account-related queries option.

- Enter your 16-digit debit card number and PIN.

- Choose the option for CIF number enquiry.

- The customer care executive will verify your identity and furnish you with your CIF number.

Linking Your Aadhaar Card with Indian Bank CIF Number

In accordance with the government of India’s directive, it is compulsory for all bank account holders to associate their Aadhaar card with their bank account.

The Aadhaar card is a 12-digit unique identification number provided by the Unique Identification Authority of India (UIDAI) to every Indian resident.

This card encompasses the individual’s biometric and demographic information, including name, date of birth, gender, address, photograph, fingerprint, and iris scan.

Connecting your Aadhaar card to your bank account opens up access to a range of government benefits and subsidies, including LPG subsidy, pension, scholarships, and more.

Moreover, this linkage acts as a safeguard against frauds and money laundering activities, given that the Aadhaar card serves as proof of identity and address.

To link your Aadhaar card with your Indian Bank account, you’ll require your Indian Bank CIF number. You can complete this linkage through any of the following methods:

Online Method:

- Visit the official website of Indian Bank at [www.indianbank.net.in]

- Click on the “Login” button on the top right corner of the homepage.

- Enter your user ID and password and click on “Submit.”

- On the dashboard, click on “Aadhaar Seeding” under the “Services” section.

- Enter your 12-digit Aadhaar number and click on “Submit.”

- Receive an OTP (One Time Password) on your registered mobile number.

- Enter the OTP and click on “Confirm.”

- See a confirmation message on the screen that your Aadhaar card is linked with your Indian Bank account.

Offline Method:

- Visit your nearest Indian Bank branch and meet the branch manager.

- Fill up a form for linking your Aadhaar card with your Indian Bank account and submit it to the branch manager.

- Attach a self-attested copy of your Aadhaar card and passbook or cheque book with your Indian Bank CIF number.

- The branch manager will verify your details and process your request.

- Receive a confirmation SMS or email that your Aadhaar card is linked with your Indian Bank account.

SMS Method:

- Type “AADHAAR <10-digit CIF number> <12-digit Aadhaar number>” and send it to 94443-94443.

- Receive an SMS that your request is received and under process.

- Receive another SMS confirming that your Aadhaar card is linked with your Indian Bank account.

IVR Method:

- Call the toll-free number 1800 4250 0000 or 1800 425 4422 from any landline or mobile phone.

- Select your preferred language.

- Choose the option for Aadhaar seeding.

- Enter your 10-digit CIF number and 12-digit Aadhaar number.

- Receive an OTP on your registered mobile number.

- Enter the OTP and confirm.

- Hear a confirmation message that your Aadhaar card is linked with your Indian Bank account.

Conclusion

We trust that this article has assisted you in discovering your Indian Bank CIF number through various methods. Feel free to choose any approach that suits your convenience and resource accessibility.

Always ensure the safety and confidentiality of your Indian Bank CIF number, given its association with your personal and financial details. Avoid sharing it with others or disclosing it on unauthorized websites or apps.

For any inquiries or feedback regarding your Indian Bank CIF number or any other services or products offered by the bank, don’t hesitate to reach out to their customer care.

FAQs

Q.1. What Does CIF Number Stand For?

The CIF number, short for Customer Information File number, is a distinctive identifier allocated by the bank to every customer. This number is utilized to store the individual’s personal and account details in a digital file.

Q.2. How many digits make up the CIF Number in Indian Bank?

The Indian Bank CIF number is an 11-digit identifier assigned to individual customers of the bank.

Q.3. What is the process for obtaining my Indian Bank CIF Number through online methods?

Retrieve your Indian Bank CIF number online by accessing your net banking account. Navigate to the “Personal Details” section on the dashboard and select “View Profile.” Your Indian Bank CIF number will be visible on the screen.

Q.4. How can I retrieve my Indian Bank CIF Number without access to a passbook or checkbook?

If you’re without your passbook or cheque book, obtaining your Indian Bank CIF number is still possible through the mobile app, SMS, or customer care. Refer to the detailed steps for each method in this article.

Q.5. Does the Customer ID in Indian Bank correspond to the CIF Number?

Certainly, the Indian Bank CIF number is synonymous with the customer ID. You can interchangeably use either of these terms to denote your distinct identification number within the bank.